Nvidia’s domestic manufacturing plans are poised to have a significant and wide-ranging impact on the U.S. economy, the global supply chain, and the broader technology industry. This is not a simple relocation of a factory, but a strategic move that affects the entire ecosystem of AI and semiconductor production.

Here’s a breakdown of the potential impacts:

On the U.S. Economy

Job Creation: Nvidia’s plans, which involve partnerships with major players like TSMC, Foxconn, and Amkor, are expected to generate a substantial number of jobs. This includes direct jobs in the new manufacturing, packaging, and testing facilities, as well as a ripple effect creating indirect jobs in construction, logistics, and supporting industries. Some reports suggest this could amount to hundreds of thousands of jobs over the next decade.

Massive Investment: The commitment of hundreds of billions of dollars in new infrastructure, including “AI factories” in states like Arizona and Texas, is a huge economic stimulus. This level of investment supports a new generation of data centers and supercomputers, boosting construction and manufacturing sectors.

Technological Leadership: By becoming a hub for the domestic production of cutting-edge AI chips and supercomputers, the U.S. solidifies its position as a global leader in AI and advanced computing. This move is directly aligned with government initiatives, like the CHIPS and Science Act, and is seen as a way to enhance national security and technological self-reliance.

Revitalization of Manufacturing: While not a complete “manufacturing renaissance” in the traditional sense, this investment in highly automated, high-tech factories signals a shift towards a new model of American manufacturing focused on the most advanced technologies.

On the Global Supply Chain

Diversification and Resilience: The primary goal of Nvidia’s move is to de-risk its supply chain. By reducing its reliance on a concentrated, overseas manufacturing base, particularly in Taiwan, the company mitigates risks from geopolitical tensions, trade disputes, and natural disasters. This creates a more resilient and secure supply chain for critical AI components.

Regionalized Production: Nvidia’s strategy, along with similar moves by competitors like Intel, points to a trend of regionalizing the semiconductor supply chain. This means producing chips closer to where they will be used, a shift from the highly globalized model of the past few decades. This could influence other companies to adopt a similar approach for their own supply chains.

Innovation in Manufacturing: The new U.S. facilities will leverage advanced technologies, including Nvidia’s own AI and robotics platforms, to optimize efficiency. This includes using “digital twins” to simulate and improve factory layouts and automation, which could set a new standard for manufacturing processes globally.

On the Technology Industry

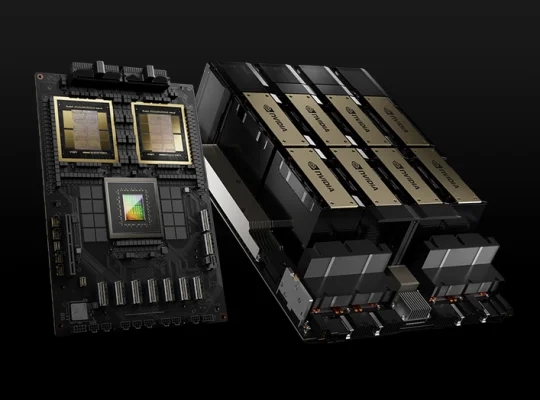

Ecosystem Development: Nvidia’s investments are not just in chips but in a complete AI ecosystem. This includes manufacturing the full “AI supercomputers,” from the chips to the systems themselves, on U.S. soil. This will foster a more integrated and robust domestic technology supply chain.

Competition and Innovation: The move puts pressure on other tech companies to also invest in domestic manufacturing or risk falling behind in securing access to critical components. This could lead to a wave of new investments and a heightened level of competition in the advanced computing sector.

Impact on Pricing: While domestic manufacturing may lead to higher production costs in some areas, the long-term benefits of a more resilient supply chain, coupled with government incentives, may help to stabilize costs and reduce the risk of price shocks caused by supply chain disruptions.