Nvidia’s substantial investment in the U.S. supply chain for chip and AI supercomputer production is poised to have far-reaching impacts across various domains:

1. U.S. Semiconductor Industry and Ecosystem:

- Boost to Domestic Manufacturing: This is the most direct impact. Nvidia’s commitment, alongside that of TSMC, Intel, and others, significantly increases the percentage of advanced semiconductor manufacturing occurring within the U.S., moving closer to the government’s goal of reducing reliance on overseas production.

- Strengthened Supply Chain Resilience: By diversifying production locations, the U.S. becomes less vulnerable to geopolitical disruptions, natural disasters, or trade restrictions that could impact chip supply from other regions, particularly Taiwan. This is a key national security objective.

- Development of a Holistic Ecosystem: It’s not just about fabs.Nvidia’s partnerships with packaging and testing companies (like Amkor and SPIL), and supercomputer assemblers (like Foxconn and Wistron), foster the growth of a more complete domestic semiconductor ecosystem, from design to final product.

- Increased R&D and Innovation: The investment is likely to spur further research and development in advanced manufacturing techniques, materials science, and AI-specific hardware design within the U.S., potentially leading to new breakthroughs.

- Competition and Collaboration: While it intensifies competition with existing U.S. chipmakers like Intel and AMD, it also creates opportunities for collaboration on foundational technologies and shared infrastructure.

2. U.S. Economy and Job Market:

Significant Job Creation: Nvidia’s stated plans to procure up to $500 billion worth of electronics over four years, with hundreds of billions manufactured in the U.S., are expected to create hundreds of thousands of jobs across high-tech manufacturing, engineering, research, and support industries. States like Arizona and Texas, already attracting semiconductor investments, stand to benefit immensely.

Economic Stimulus: The massive capital expenditure on new facilities, equipment, and workforce development will inject substantial funds into the U.S. economy, creating a ripple effect across various sectors.

Skilled Workforce Development: The demand for highly skilled engineers, technicians, and researchers will necessitate increased investment in STEM education and training programs, helping to build a more robust and specialized talent pool in the U.S.

3. Geopolitical Landscape and National Security:

- Enhanced “AI Sovereignty”: By producing critical AI chips and supercomputers domestically, the U.S. gains greater control over the foundational technology of AI, bolstering its “AI sovereignty” and reducing dependence on foreign supply chains for this strategically vital technology.

- Leverage in Tech Competition: A stronger domestic manufacturing base provides the U.S. with more leverage in its technological competition with rivals, particularly China. It allows for more effective implementation of export controls while ensuring a reliable domestic supply for critical applications, including defense and intelligence.

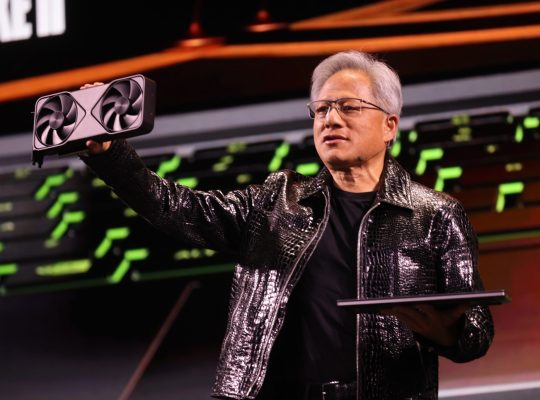

- Complex Relations with China: While the investment aims to reduce reliance on foreign supply chains, Nvidia’s CEO Jensen Huang has also worked to maintain a delicate balance with China, acknowledging it as a crucial market. The company has developed compliant chips (like the H20) to navigate U.S. export restrictions while trying to maintain market access. The recent policy reversal allowing H20 sales indicates the complexity of this geopolitical tightrope walk.

- Shifts in Global Supply Chains: Nvidia’s move could inspire other technology companies to re-evaluate their own supply chain strategies, potentially leading to a broader trend of “reshoring” or “friend-shoring” advanced manufacturing, further diversifying global supply chains.

4. Competition within the AI and Semiconductor Industries:

- Intensified Competition in AI Hardware: Nvidia’s strengthened U.S. manufacturing capabilities will likely intensify competition with other AI chip developers like Intel (with its Gaudi accelerators) and AMD (with its Instinct series), as well as emerging AI chip startups.

- Integration and Ecosystem Lock-in: Nvidia’s investment in producing entire AI supercomputer systems in the U.S., along with its dominant CUDA software platform, further strengthens its full-stack AI ecosystem. This could make it even harder for competitors to challenge Nvidia’s market leadership.

- Opportunities for Domestic Suppliers: The increased domestic production will create opportunities for U.S.-based suppliers of raw materials, manufacturing equipment, and components, strengthening the entire domestic semiconductor supply chain.

5. Environmental Impact and Sustainability:

- Energy Consumption: Semiconductor manufacturing is highly energy-intensive. While Nvidia is investing in energy-efficient designs for its chips (like Blackwell’s lower power consumption per workload), the expansion of U.S. fabs will necessitate significant energy infrastructure. The push for renewable energy sources for these facilities will be crucial.

- Water Usage: Chip manufacturing requires vast amounts of ultra-pure water. The location of new fabs in water-stressed regions (like Arizona) raises concerns about sustainable water management and the potential impact on local water supplies.

- Chemical Waste and E-waste: The production process generates hazardous chemical waste, and the increasing volume of chips and AI hardware will contribute to electronic waste. Nvidia’s commitment to responsible waste management and recycling programs will be vital.

- Potential for Green AI: Nvidia emphasizes that its powerful AI chips can enable significant energy savings in data centers and other industries through optimized algorithms and digital twins (e.g., in manufacturing, climate modeling). This positions AI as a tool for environmental benefit, despite the energy demands of its creation.

Overall, Nvidia’s investment is a transformative development, reflecting a global recalibration of supply chains and a heightened focus on technological sovereignty, particularly in the critical domain of artificial intelligence. Its impacts will be felt across technology, economics, and international relations for years to come.